To measure the success of a business, marketers often track and measure a few key metrics like website traffic, sales revenue, profit margin, and so on. However, one metric that is often overlooked is the customer lifetime value or CLV.

Customer lifetime value indicates the average amount of money a customer will spend on your business over the entire lifecycle of his/her relationship with your brand.

The importance of Customer Lifetime Value

Every marketer has to bear customer acquisition costs for individual customers. While the initial customer acquisition costs may be equal to the money, you make from that customer’s first purchase but are you still making money from that customer?

That’s what CLV seeks to answer. Since CLV is a customer-oriented metric, it can become a powerful tool for customer retention, boosting the ROI, and improving the overall customer experience.

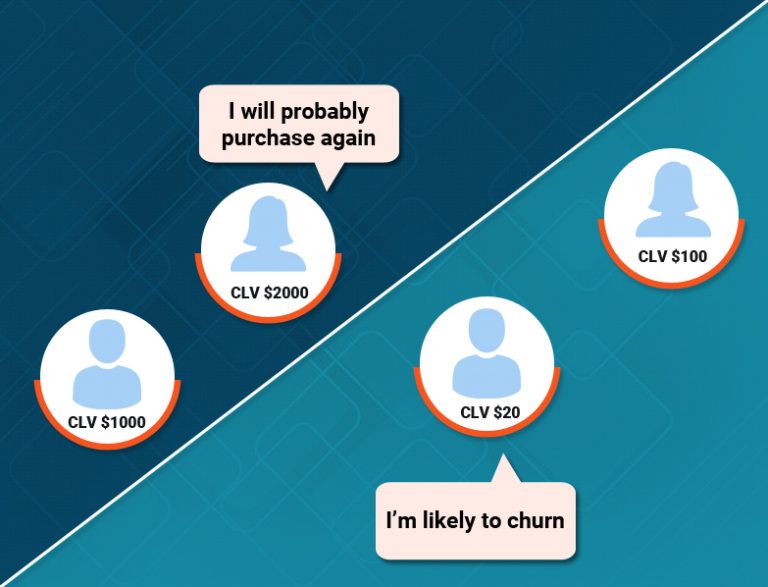

By determining the customer lifetime value, you can better understand the different buyer personas of your customer base and take necessary steps for customer retention. This allows you to streamline and narrow down your focus to deliver personalized customer experience to individual buyer personas. For instance, you can send assorted gifts or offer exclusive deals to your VIP customers to retain them. As for the less valuable customers, you can gradually start upselling to them (by offering discounts/bonus offers/prizes, etc.) to boost their CLV.

Once you calculate customer value, you can design your marketing strategies accordingly – some customers bring more revenue than others.

Most importantly, CLV depicts how successful your products/services and marketing strategies are with your target audience. It also highlights everything you’re doing right and what you’re doing wrong when it comes to customer acquisition and customer retention.

Other benefits of CLV include:

- It helps align marketing campaigns with the company’s financial goals.

- It helps measure the bottom-line financial results of marketing efforts.

- It helps to understand the profit contribution of various buyer segments.

- It helps take an ROI-oriented approach to marketing by calculating the balance between customer acquisition, share-of-customer, and loyalty objectives.

- It balances the competing needs of short-term profits and long-term financial goals.

How can ML help in calculating Customer Lifetime Value?

Historical methods of calculating customer lifetime value observe the patterns in the past data to make conclusions on the customer lifetime value of a customer solely based on their previous transactions. What these fail to address is, what will the customers do next?

This is where ML can come in. ML methods of CLV prediction (such as CLV model, RFM model, NBD-Pareto model, and MRE model) not only calculate the present trends in the CLV, but they also offer valuable insights about the future. Marketers can know what kind of relationship will their customers have with their brand/s, how will they interact with their brand in the near future, will they leave anytime soon, and other such matters. What’s more is that ML models offer accurate predictions, leaving no scope to falter.With such vital information at their disposal, marketers can reshape and rethink their future decisions, strategies, and campaigns to maximize profits and boost the CLV. As businesses continue to realize the potential of ML, there’s enormous potential for ML to become a mainstream technology behind uncovering the customer lifetime value.

We’re here to make AI work for you.

Talk to our team today and start your AI journey. Whether you have questions about our services, need support, or want to discuss a potential project, our team is ready to help.

Social network

sales@netsmartz.com